Summary:

- Moneyhub are migrating users to WPS Advisory’s LifeStage app from mid-July 2025, but this offers the same underlying technology with the same limitations – users still won’t get the multi-currency support and secure family sharing features they’ve been requesting for years

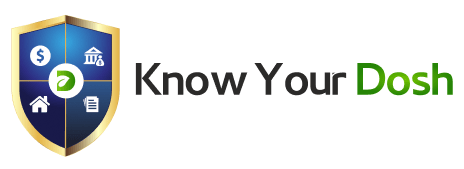

- Know Your Dosh delivers the features Moneyhub users have been asking for – true multi-currency support across 150+ currencies for global families, and secure family sharing with granular permission controls that let you share mortgage details with your spouse whilst keeping investments private

- Instead of accepting another migration to limited technology, Moneyhub users can upgrade to a platform built for global families – with simple setup, FCA regulation, and no corporate handoffs or account transfers

In a recent announcement, Moneyhub shared its strategic decision to exit the direct-to-consumer (D2C) app market to focus on its core Business-to-Business (B2B) offerings. Starting mid-July, users will see a migration screen directing them to WPS Advisory’s LifeStage app – essentially the same Moneyhub app and technology, but with different branding. Whilst this corporate handoff may seem convenient, it leaves thousands of loyal consumers with the same limitations they’ve been requesting fixes for over the years.

Know Your Dosh (KYD) emerges as the perfect solution for former Moneyhub users, finally delivering the secure family sharing and multi-currency support that the Moneyhub community has been requesting for years, alongside an advanced platform that prioritises transparency, security, and global accessibility.

1. Finally: The Multi-Currency Support Moneyhub Users Have Been Requesting

For years, Moneyhub users have asked for proper multi-currency support for their international assets and global family finances. The transition to WPS Advisory’s LifeStage app offers the same underlying Moneyhub technology – meaning the same limitations persist.

KYD delivers what you’ve been waiting for:

- True Multi-Currency Dashboard: View your complete financial picture across GBP, USD, EUR, and 150+ currencies with real-time conversion

- Global Asset Tracking: Whether it’s property abroad, international investments, or overseas pensions, see everything in your preferred currency

- Cross-Border Family Wealth Management: Perfect for expat families and international investors who’ve been underserved by UK-only platforms

2. Secure Family Sharing That Actually Works

Another long-standing request from the Moneyhub community has been robust family sharing capabilities. Instead of getting this feature, users are being migrated to the same technology platform under WPS Advisory’s management.

KYD’s secure family sharing includes:

- Granular Permission Controls: Share mortgage details with your spouse whilst keeping investment portfolios private

- Multi-Generational Access: Include adult children in family financial planning with appropriate security boundaries

- Emergency Access Protocols: Ensure family members can access critical information when needed, without compromising day-to-day privacy

- Collaborative Financial Planning: Work together on family goals, budgets, and major financial decisions

3. Advanced Global Family Financial Management

Whilst the LifeStage app offers “familiar features” from the same Moneyhub platform, KYD provides the comprehensive global family financial management that goes far beyond traditional personal finance:

- Real-Time Global Asset Tracking: Synchronise financial data across multiple countries and currencies

- Family Financial Collaboration: True household financial management with secure sharing controls

- International Goal Planning: Set and track financial goals across borders and currencies

- Dormant Asset Protection: Prevent your family’s global wealth from becoming part of the billions in unclaimed assets worldwide

4. Data Security Without Corporate Handoffs

As Moneyhub transfers user accounts to WPS Advisory, KYD offers something different: stability and security without third-party transitions. As a globally-focused, FCA-regulated platform, KYD prioritises the security of your international family’s financial data with bank-level encryption and privacy protocols designed for cross-border households.

5. Transparent Global Pricing

Unlike the uncertainty of subscription transfers and new pricing structures that come with corporate migrations, KYD’s flexible subscription plans are designed for global families. Our transparent pricing structure accommodates diverse international needs without hidden fees or regional limitations.

6. Dedicated Support for Moneyhub Users During Transition

We understand the frustration of waiting years for features that never materialised. KYD’s customer support team is specifically prepared to assist Moneyhub users in transitioning to our platform, with particular focus on setting up the multi-currency and family sharing capabilities you’ve been requesting. Whether through live chat or email, we’re here to deliver the experience Moneyhub couldn’t.

Benefits for Former Moneyhub Users

By choosing KYD over the LifeStage migration, Moneyhub users finally gain access to:

- The multi-currency support they’ve requested for years

- Secure family sharing with granular controls

- Global financial management capabilities

- A platform that evolves with international family needs

- No more corporate handoffs or account migrations

Don’t Just Migrate – Upgrade

As Moneyhub directs users to WPS Advisory’s LifeStage app (the same technology with different branding), KYD offers former Moneyhub users the opportunity to finally get the global family financial platform they’ve been asking for.

Instead of accepting another compromise, transition to KYD and experience the multi-currency support and secure family sharing that should have been available years ago.

Sign up today and get started with the financial management platform built for global families.

At KYD, we’re not just offering another migration option; we’re delivering the innovative global family financial management that the Moneyhub community has been requesting all along.